Chicago offers tremendous strengths and grapples with systemic weaknesses, from a diverse economic base and strong anchor institutions to persistent segregation and widespread financial burdens. Targeted investments and a long-term approach can set our region up for success. Here's an inside look at a recent conversation among MPC's Executive Advisors

By Jacques Gordon, MPC Board of Governors

By Jacques Gordon, MPC Board of Governors - June 10, 2021

MPC’s Executive Advisors met virtually in May 2021 to compare notes on how some of Chicago’s leading employers fared during the pandemic, what their leaders learned from the experience, what they are grateful for, and how/when their workforce is planning to return to the office. I presented these findings alongside MPC Vice President Kendra Freeman, with help from Dan Mahoney, a Managing Director at LaSalle Investment Management.

As we saw during the pandemic, not all residents share equally in Chicago’s prosperity

From an economic perspective, Chicago’s greatest asset is its current 4.8 million in employees. By this measure, the Chicago metro ranks third in the U.S., and tenth globally among metropolitan areas across all developed countries. This diverse employment base creates a durable source of income for many Chicagoans, but as we saw so clearly during the pandemic, not all residents share equally in Chicago’s prosperity. Between February 2020 and February 2021, the region lost 390,000 jobs according to the Bureau of Labor Statistics. And while employment is beginning to rebound, four years from now, the region is projected to regain just half of these lost jobs, according to forecasts by Oxford Economics.

Low-wage workers were hit especially hard by the pandemic. Nearly half of the job losses in the region were among low-wage workers and the vast majority (110,000) were in Cook County. MPC’s mapping analysis shows that losses among low-income workers hit double-digits (10% to 14%) in many parts of the City of Chicago – a much higher rate than the collar counites.

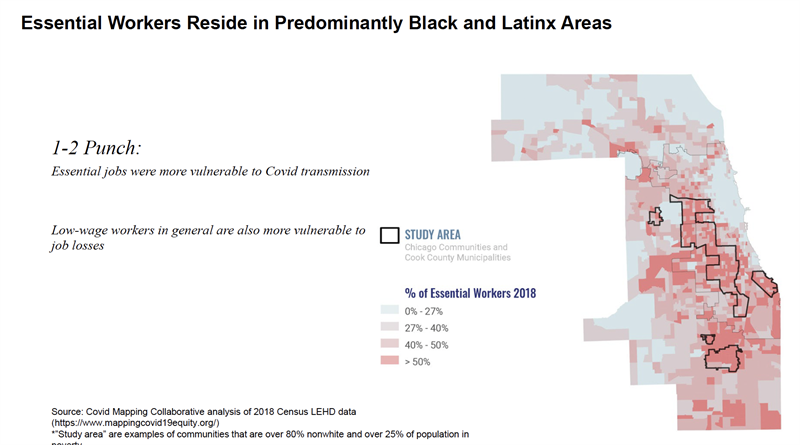

Moreover, essential workers reside in predominantly Black and Latinx neighborhoods. These front-line workers played a key role in keeping the health care and food distribution systems functioning during the worst phases of the pandemic.

In contrast, the moratorium on residential evictions has had a meaningful, positive impact on thousands of Chicagoans. Prior to the pandemic, evictions were running at the rate of 1,500 per month. During the pandemic, evictions averaged just 100 to 200 each month. The eviction moratorium is about to expire, presenting a new risk to the region.

Economists expect record levels of GDP growth and job creation at the national level. How is the Chicago region likely to participate in this recovery? An assessment of the region’s strengths and weaknesses helps frame the outlook.

Chicago’s relative strengths:

- Central, hub location for air, highways, and rail transport networks

- Gateway destination for immigrants and a favored job destination for recent college graduates

- Strong anchor institutions including world-class universities, research hospitals, museums, exhibition spaces, and cultural events

- A vibrant urban core with a strong transit backbone

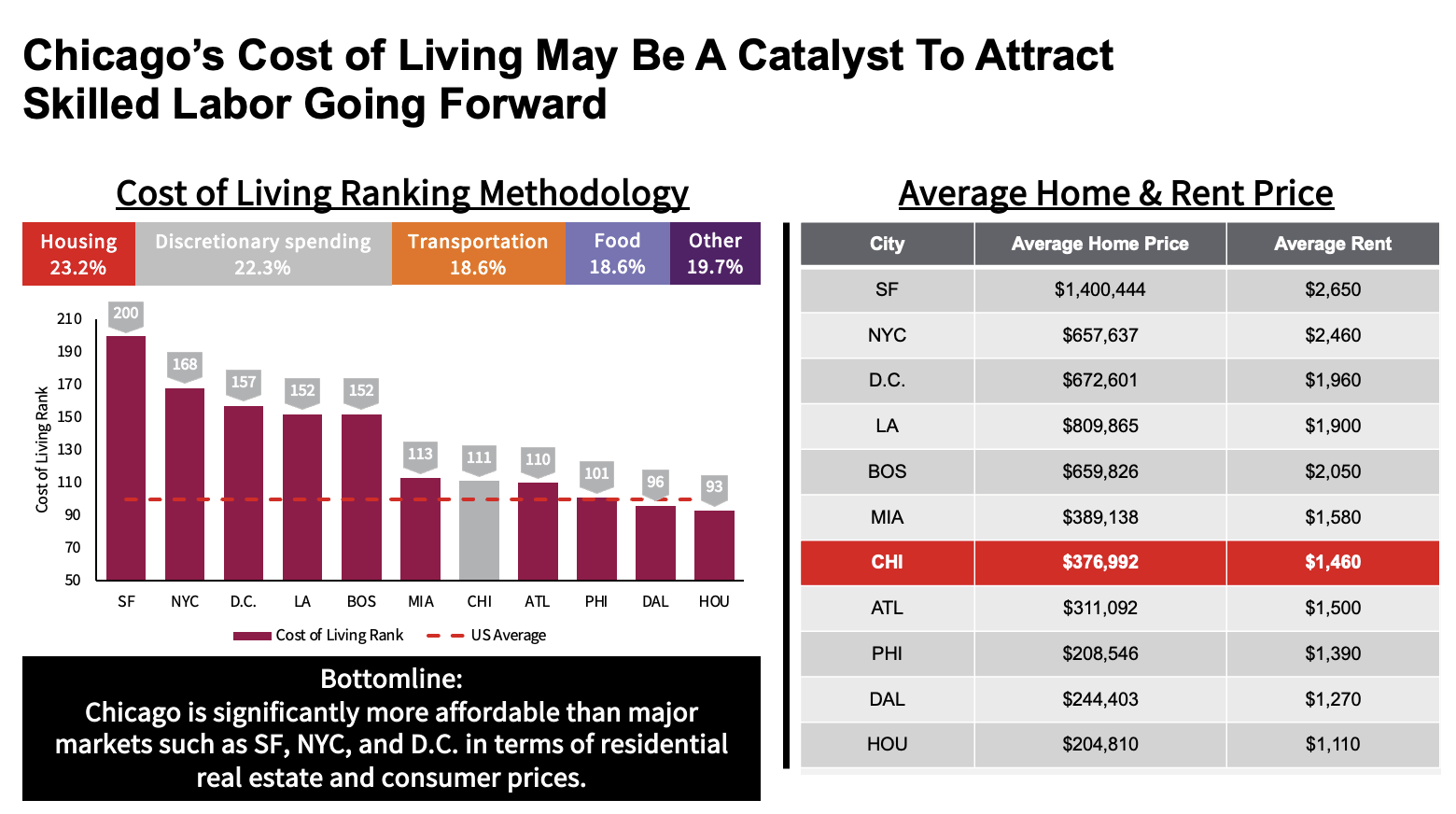

- A more affordable housing market and lower labor costs than coastal metros

Chicago's relative weaknesses:

- A persistent pattern of segregation that creates costs for the entire region

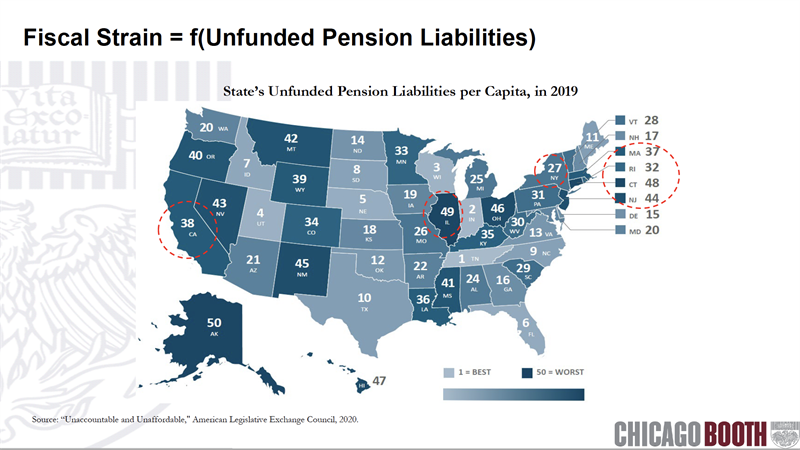

- Weak fiscal outlook and a rising tax burden

- Disparities in income, health care, public safety, and education

- Aging infrastructure that suffers from years of neglect

- Weak demographic outlook following Illinois and the City of Chicago both losing population between 2010 and 2020

Chicago has among the most diverse economies of the nation’s top ten metros. This is another core strength of the economy. It shows up in less severe spikes in office vacancy during the pandemic, compared to San Francisco, Seattle, Dallas, New York, and Houston.

Recent statistics from JLL show that after a very slow Q4 2020, the number of requirements for office space has tripled in Q2 of 2021. Apartment rents plummeted during the pandemic but are on the rise again in the Near North and Downtown neighborhoods—both of which experienced double-digit drops in rents during 2020. Overall, Chicago’s housing costs rank seventh out of the largest ten metros in the US, which makes the region attractive for many corporate headquarters and Midwest regional hub offices.

Yet, as businesses decide where to expand or relocate after the pandemic, the fiscal and tax situations in Chicago, and more broadly across Illinois, are far from ideal. The total tax burden faced by Illinois households ranks ninth in the nation, when property taxes, personal income and sales taxes are bundled together. More troubling is that Illinois ranks 49 out of 50 states in terms of the total fiscal strain (defined by state deficit/surplus and unfunded pension liabilities)*. *Prof Joseph Pagliari, University of Chicago, “Are the Gateway Markets Overpriced?” Real Estate Research Institute May, 2021

In sum, the region contains a complex blend of assets and liabilities. The assets include a diverse economic base and a helpful tailwind of a strong national recovery. The liabilities are readily identifiable. They can be addressed through a combination of strong business and political leadership. To succeed, it will take a strong commitment by the Governor, the State legislature and municipal leadership to tackle a triple systemic threat: 1) Fiscal sustainability, 2) High costs of segregation and disparities of access to educational and economic opportunities across this complex region and 3) Aging infrastructure. The CARES Act and President Biden’s Infrastructure proposals could provide a much-needed down payment for all three of these systemic issues. It will also take a persistent approach to working on these issues throughout the rest of the decade in order to turn these liabilities into assets.

Jacques Gordon is a Global Investment Strategist with LaSalle Investment Management and an active member of the MPC Board of Governors.