Photo by Ben Schulman

Congress for the New Urbanism's CEO & President John Norquist explains CNU's latest initiative, Live/Work/Walk: Removing Obstacles to Reinvestment.

By Ben Schulman

By Ben Schulman - January 25, 2012

"It all started with the best of intentions."

So began John Norquist's - the CEO & President of the Congress for the New Urbanism - presentation last week on CNU's latest initiative, "Live/Work/Walk: Removing Obstacles to Investment." Hosted by design firm a5 in their downtown Chicago office, and co-sponsored by their GreenTown conference, the kick-off event for the initiative attracted a packed crowd to listen to Norquist and Center for Neighborhood Technology President (and CNU Board Member) Scott Bernstein discuss how current federal housing financing restrictions obstruct investment in and development of mixed-use properties and districts. With demographic trends increasingly expressing a desire for such communities, Norquist and Bernstein illustrated how these regulations act as obstacles that prevent investors and developers from being able to meet market demand.

The "best intentions" Norquist spoke of referred to the aspirations behind the New Deal creation of the Federal Housing Authority. Intended to stabilize the then-imploding housing market, the establishment of FHA would eventually lead to a redefining of how risk was measured for financing requirements. Standing in front of an 1930s-era photo of his uncle's two-story residential/commercial building — "a carpentry shop on the bottom and two apartments above" — Norquist noted how "banks used to appreciate it if your property had a mix of uses. If the carpentry shop was failing, the bank would consider the rent from the apartments above and say 'Great, you can still pay the mortgage.'"

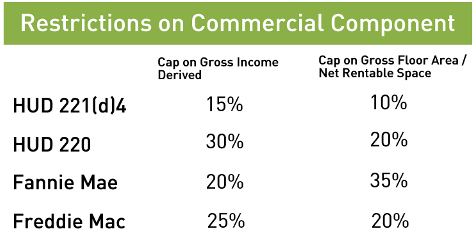

Yet the establishment of FHA, and GSEs Fannie Mae and (eventually) Freddie Mac, changed this. Mixed-use was treated not as a diversified check against loss, but rather, as an assessment of financial risk itself. Given that private lenders tend to adopt even more restrictive policies than federal underwriting rules, these federal regulations encouraged a move away from financing Main Street-style developments, essentially making it impossible to build traditional neighborhood districts in the post WWII-era. By assigning risk to development type, federal financing restrictions inadvertently helped create the worst performing and riskiest investments in the wake of the slowly-recovering housing crisis: single-use, sprawled-out areas at the metropolitan edge. And as current federal financing restrictions under FHA, Fannie Mae, Freddie Mac, and HUD's 221d4 and 220 programs continue to limit non-residential use to a small percentage of the net rentable space or imputed rent of a given project, the result has led to a perversion of form that has impeded market recovery.

Channeling author Carol Willis, CNT President Scott Bernstein used the phrase "form follows finance" to zero in on the economic consequences of the current regulations. Developers may have taken their cues from federal rules to deliver single-use zoned product, but ironically, those rules missed the inherent risk to the form. CNT's data of residential and commercial foreclosure rates in greater Chicagoland reveal residential-only properties carrying a three-to-five times greater risk of falling into foreclosure than commercial property. Bernstein's findings show FHA/HUD, Fannie Mae and Freddie Mac's assessment of risk to be backwards. Relaxing financing restrictions to allow for mixed-use development — combining the relative safety of commercial properties to keep residential loan performance in-line — would work to reduce risk.

Photo by Ben Schulman

More so, it would allow money to respond to an emerging demographic demand that is eager for mixed-use communities. Estimates from University of Utah professor Arthur C. Nelson state that the current supply of unattached single-family housing already exceeds projected demand and will continue to do so until 2037. This coincides with a 60 percent increase in multi-family housing starts in 2011 over the preceding year. In the recent New York Times op-ed,"The Death of the Fringe Suburb," Christopher Leinberger wrote of "the convergence of the two largest generations in American history, the baby boomers and the millennials," who together are driving the "pent-up demand for walkable, centrally located neighborhoods." But current financing obstacles prevent investors from investing in and developers from developing this product. Developers like Chicago's Joe Williams, whose designs for a mixed-use settlement on the site of the former Ida B. Wells housing project in the city's Bronzeville neighborhood were thwarted when the building's commercial component disqualified it from FHA standards. Without a financing portal, Williams' eager buyers simply left the marketplace. The net effect of federal financing restrictions is to push a product that doesn't sell well through perverse incentives that end up acting like central planning. And it ends up preventing developers like Joe Williams from delivering communities.

It is time to translate space to its utmost economic utility. To remove obstacles to investment in these economic times, the government should heed market demand, reassess its risk profile, and allow a mix of commercial and housing development to act as a catalyst for economic growth. Working with our coalition of partners such as the National Association of Home Builders, the National Town Builders Association, the National Association of Realtors, CNT, and more, the Congress for the New Urbanism is advocating for the relaxation and/or elimination of the restrictive covenants on commercial space in traditional neighborhood districts. As stated by CNU President John Norquist at the "Live/Work/Walk" event, removing these obstacles to investment will “unlock opportunity in the American economy.”