By Matt Maloney, Deputy Chief of Staff, Chicago Metropolitan Agency for Planning

By Matt Maloney, Deputy Chief of Staff, Chicago Metropolitan Agency for Planning - August 8, 2012

Taxes have an impact beyond the public revenue they raise—the structure of the tax system influences the planning and economic decision-making that shapes our communities. To create livable communities and keep our region economically competitive, state and local tax systems should encourage effective land use and sustainable economic activity. Our tax policies should avoid causing large inequities between households, businesses, and local governments and should be transparent and predictable for taxpayers.

GO TO 2040, the comprehensive plan for northeastern Illinois, recommended that state and local tax policies should be studied "through the lens of the regional economy, sustainability, equity, and the connections between tax policy and development decisions" by a Regional Tax Policy Task Force. Earlier this year, the Task Force issued its advisory report to the Chicago Metropolitan Agency for Planning (CMAP) Board, and agency staff has been investigating a number of related issues, including the region’s complex property tax system.

- Decoding Property Taxes and Classification explains how property tax rates are determined, what the taxes pay for, which government units get the revenue, and why property tax assessment classification matters. Using the brief's interactive, data-driven graphics, users can also compare the formula used in Cook—where assessment ratios vary depending on land use (residential, industrial, or commercial)—with the across-the-board 33 percent ratio in the region's other counties. One local tax policy worthy of examination is Cook County’s property tax assessment classification system, which may hinder business development efforts and economic opportunity. To explore the topic and help educate local elected officials, decision makers, and the public on this complex topic, the Chicago Metropolitan Agency for Planning (CMAP) released two interactive web-based issue briefs this summer:

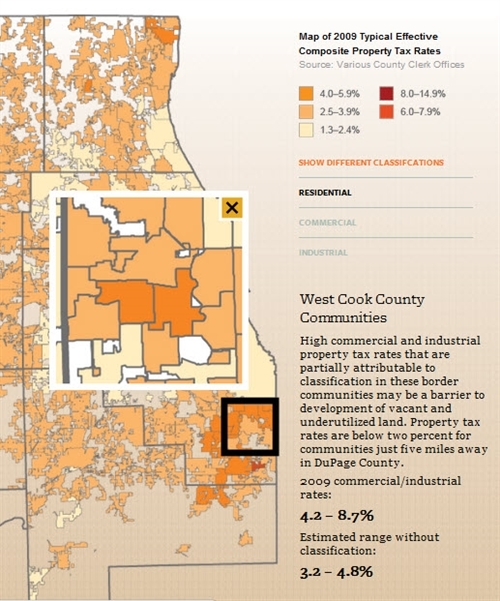

- Cook County Property Tax Classification drills deeper into the issue with case studies to show where phasing out Cook County’s classification system over time could help attract businesses to neighborhoods sorely in need of economic development. By exploring a clickable map and related data, the user can compare how residential, commercial, and industrial property tax rates vary across West Cook and South Cook communities.

Unfortunately, the property tax classification system in Cook County makes the areas in most need of redevelopment less appealing for new businesses to locate in comparison with other locations in the region. As explored in the second issue brief, while the collar counties offer effective commercial and industrial property tax rates below 4 percent (as a percent of market value), in Cook County those effective rates can be as high as 8.7 percent in west Cook and 11.3 percent in south Cook. High tax rates can perpetuate a cycle where new businesses do not locate in the very communities that are most in need of economic development. As CMAP will continue to investigate through its Policy Updates blog, phasing out the property tax classification system in Cook County may help to break this cycle.

.