Emily Cikanek

University of Chicago employee Natasha Rodwell sits with her family in the home she bought with the help of the university's Employer-Assisted Housing program.

Employee turnover is a fact of life for all companies, and more than a simple inconvenience; turnover means an employer must adjust its operations to go on without the lost employee or search for, hire and train a new one. The costs to the company associated with these fluctuations can be staggering; the challenge for employers is to try to head off these costs with proactive solutions that keep talented employees for the long haul.

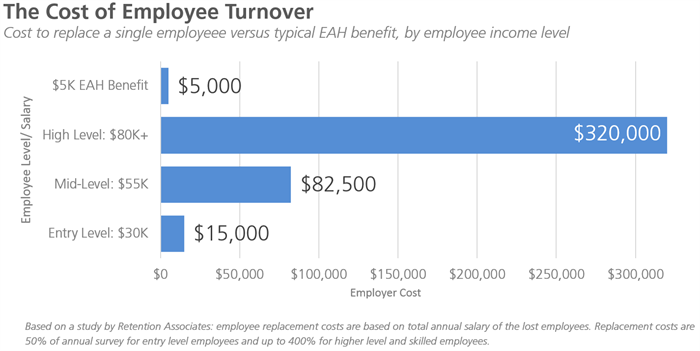

One nationwide study of 333 hospitals found that turnover of registered nurses accounted for 68 percent of the variability in per-bed operating costs. A number of human resource studies have shown that hiring and training new employees can cost companies between 50 percent and 400 percent of an employee’s annual salary, depending on their level of specialization. For small businesses, the loss of an employee is even more damaging.

Lower turnover rates have been shown to improve sales growth and workforce morale. In addition, high-performance human resources practices increase a company’s profitability and market value. This makes proactive retention strategies even more essential for an employer’s bottom line.

The solution? Employer-Assisted Housing

Since 2001, the Metropolitan Planning Council (MPC) has been promoting Employer-Assisted Housing (EAH), a proven strategy that extends housing affordability for employees while enhancing the competitiveness of businesses. Through EAH, companies provide guidance and financial assistance to employees who purchase or rent homes in or near communities where they work.

With our new EAH Guidebook, which we are very excited to release today, we have given employers the tools they need to explore the possibilities that EAH offers them and their employees. The guide provides information on all steps of the EAH process, and answers some of the most common questions that I hear in meetings with prospective employers:

- “What is the benefit to my organization?"

- “How will this help my bottom line?”

- “How can I make this fit into my budget?”

- “How can I legitimize this use of taxpayer funds?”

Put simply, EAH pays for itself. The costs of EAH are small compared to the costs of employee turnover.

A smart investment

Let’s say that an employer designs their EAH benefits to offer employees a one-time, $5,000 forgivable loan for housing downpayment assistance. The forgivable five-year loan structure means that the employee will accept that loan in exchange for their five-year commitment to remain with that employer. That is $1,000 per year to retain an employee—a fraction of the cost to find and replace even an entry level employee earning $30,000 (see chart below).

The Society for Human Resource Management produced a report entitled Retaining Talent: A Guide to Analyzing and Minimizing Employee Turnover, which found that “Employees who have many connections are more embedded, and thus have numerous reasons to stay in an organization.” Some of the ways the Society encourages employers to connect with their employees include building ties between your company and the community and encouraging home ownership (for instance, by providing home-buying assistance).

Employer-Assisted Housing benefits represent an opportunity for employers to make both of these connections, helping to stabilize their workforce and limit the cost of turnover. EAH is a smart investment for companies to make: It increases retention and costs a fraction of the replacement and training costs that come into play with turnover. More businesses should consider investing in their workforce through retention-driven tools like EAH; the result is a stabilized workforce, investment in communities in which they are embedded and limited funds spent to decrease turnover.