Congressional Budget Office

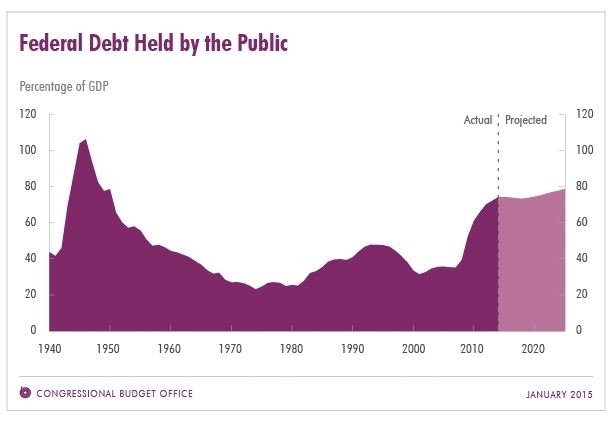

Federal debt held by the public will be 74 percent of gross domestic product at the end of this fiscal year. While similar to post-WWII levels, read on to find out why the debt will have different long-term ramifications.

The Congressional Budget Office’s new economic and budget outlook makes it abundantly clear that states and local governments must look to themselves to address budget deficits and make investments in infrastructure and community development projects that will drive economic growth.

The Congressional Budget Office forecasts that the federal budget deficit (the difference between how much revenue the government takes compared to spending) will remain steady through 2018, at 2.5 to 2.8 percent of gross domestic product. It then will rise to 4.0 percent of gross domestic product in 2025, increasing from $486 billion in 2014 to over $1 trillion. Federal debt held by the public (the total amount of money that the United States federal government owes to creditors) will be 74 percent of gross domestic product at the end of this fiscal year, higher than any year since just after World War II.

Debt is different this time around and it’s bad news for state and local governments

During World War II, the federal government spent like never before on war planes, tanks and ammunition. That spending also produced jobs, both military and manufacturing, and was a one-time investment. When the factories no longer needed to build government defense systems, private investors took over and, fueled by a young labor market, turned those factories into a growing manufacturing sector that produced goods like telephones and toasters. Private investment grew and, after a long war, consumers were ready to spend. All that manufacturing and consumer spending fueled revenues going to federal coffers. These factors enabled public investments like the G.I. Bill and the national highway system, and meant training and jobs for those returning from war. Though 20 million people left war jobs, the unemployment rate rose only slightly from 1.9 percent to just 3.9 percent between mid-1945 and mid-1947.

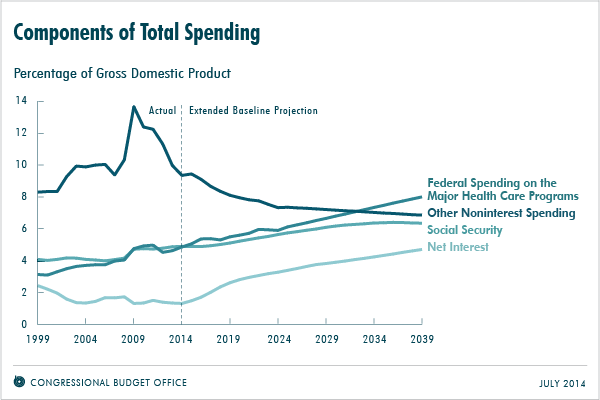

The Congressional Budget Office forecast reports federal spending in 2015 and beyond will largely be payments to retiring Baby Boomers—Social Security and Medicare—and interest on federal debt. These are programs much different from the WWII era, when spending was driven by manufacturing war products and then education and infrastructure initiatives. And unlike a war, today’s biggest budget payments (Social Security and Medicare) are infinite and won’t produce the economic returns manufacturing or infrastructure investments did in the late 1940’s and early 50’s. Spending on infrastructure, for example, produces up to a four-to-one return on investment and 42,000 jobs for every $1 billion spent.

Congressional Budget Office

Over the next decade, spending on Social Security and Medicare alone will grow by 60 percent, while spending on programs like transportation, education and the environment—spending that fuels state and local government investments—will only grow by 16 percent.

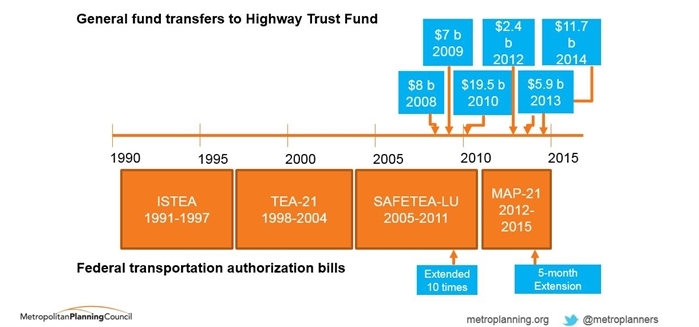

After World War II, we built the national highway system. Contrast that feat with today, when Congress hasn't passed a "long-term" transportation authorization in a decade. The last one, SAFETEA-LU, had to be extended ten times due to Congressional gridlock.

Much of the debt after WWII was held by American people, through war bonds. So when the federal government paid the bonds back—which it was able to do because the growing U.S. economy resulted in more tax revenues—people (the bond holders) spent the money on U.S. manufactured goods, which in circular fashion produced more jobs manufacturing toasters and telephones and more tax revenues. Today’s federal debt is mostly held by foreign entities. When the government pays them back, it’s unlikely they’ll be in the market for a U.S.-made toaster.

Yonah Freemark

People also had a lot of personal savings back then, which they wanted to spend after years of war. In the 1950’s the savings rate was around 11 percent of the total disposable personal income; today it’s just 4.9 percent.

And at over $11 trillion, today’s ever-rising consumer debt (credit cards, student loans and mortgages) stifles economic growth.

These data points only strengthen the fact that state and local governments must chart their own economic futures to ensure their success. The time for relying on the feds is over. States need their own investment strategies.

Given Illinois’ dire fiscal situation, a $9 billion budget deficit and rising pension costs at the state and local level, Gov. Rauner has placed all options on the table for securing Illinois future. We’ll all be waiting to hear his goals for growing Illinois in his first State of the State address today and his budget proposal on Wednesday, Feb. 18.