Smoother roads and more reliable trains and buses? One of the major outcomes of the spring 2019 legislative session was passage of the Rebuild Illinois package including significant funding for transportation capital investments. So, how will this make Illinois residents’ lives better? Here are the details:

How does the funding work?

This package will infuse an additional $20 million of transportation funding into Illinois over six years. Individual pieces of legislation include Senate Bill 1939 primarily addressing revenue for transportation projects, Senate Bill 690 primarily focused on revenue sources for other construction, House Bill 62 including capital appropriations and specific projects, and House Bill 142 authorizing bonding. Just over half of the total will be funded raised through bonding and the remainder will come from ongoing annual transportation revenues.

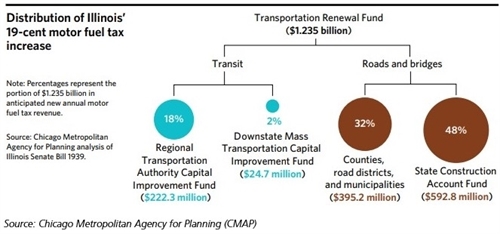

A victory for sustainable revenueWhere will the money come from? The legislation doubles the state motor fuel tax (MFT) from 19 cents per gallon to 38 cents per gallon, effective July 1, 2019. In addition, the gas tax will be indexed to the Consumer Price Index, so revenues will keep up with the costs of operating and improving the system. The higher tax imposed on diesel fuel, known as the diesel differential, will also increase from 2.5 cents per gallon at present to 7.5 cents per gallon to help account for the impacts of trucks transporting freight, which cause additional wear and tear on the roadways due to vehicle weight. While the 38 cent per gallon base rate is indexed to inflation, the 7.5 cent differential is not. Instead of a discounted $35 biennial electric vehicle registration fee, electric vehicle owners will now pay the same base registration fee as all vehicle owners plus an additional $100 fee to compensate for not paying MFT.

It is a major achievement that the Rebuild Illinois investments will be funded with sustainable annual sources of transportation funding—motor fuel tax and vehicle registration fees—compared to previous capital bills that relied on non-transportation sources that did not generate as much funding as anticipated. This revenue is protected by the “lockbox” constitutional amendment that passed in November of 2016 mandating that transportation revenues be used only for transportation.

What about public transit?

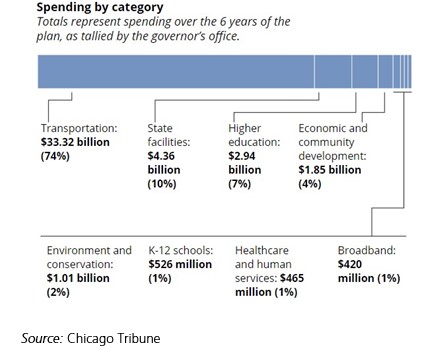

MPC focused much of its advocacy efforts on ensuring that transit received a significant share of the transportation funding, given transit’s contribution to the equity, affordability and environmental friendliness of the system. In preparation for this legislative session, MPC developed communications tools for legislators. We rolled out #Busted Commute, a social media campaign and photo album highlighting the need to invest in Illinois’ crumbling transportation infrastructure, and Transit Means Business, a report highlighting how much employers depend on transit to access talent, and the extent to which transit provides regional resiliency. The approximate breakdown is $14 billion for roads and bridges, $4.5 billion for transit, and $1.5 billion for passenger rail, freight rail, ports and airports. So ultimately transit received about 22.5 percent of Rebuild Illinois transportation funding. While we wished the transit share were a bit higher, an important facet of the package is that for the first time, 20 percent of new motor fuel tax revenues are dedicated to transit capital, which amounts to a perpetual revenue stream of about $250 million per year for transit. While transit maintenance needs have been estimated at a much higher $3 billion per year, this is a great start in term of providing increased funding reliability for CTA, Metra and Pace. Another very positive element is that annually $50 million of the Road Fund is set aside for bicycle and pedestrian enhancements. These funds will be awarded through the Illinois Transportation Enhancements Program, and communities with higher needs will be given priority for funding.

We have money. Now, where and how do we deploy it?

While in one sense the work of obtaining sustainable transportation funding for Illinois is over, in another, the work is just beginning. Significant effort will be required to prioritize and deliver the right projects for the residents of Illinois with these precious tax dollars. Critically, funds need to go to fixing what we have first. IDOT will rely on its new federally required Transportation Asset Management Plan to guide maintenance investments.

MPC has strongly advocated for performance-based planning to ensure we get the best outcomes for every tax dollar, and to build the public’s trust in government. This summary of an event MPC hosted two years ago featuring former IDOT Secretary Randy Blankenhorn, describes the state’s then-new tool for project prioritization. Now that additional resources have been secured, it is critical that an improved version of this tool be deployed to prioritize transportation. Any projects other than maintenance should go through this data-driven process. On the transit side, agencies will need to adhere to their new federally required Transit Asset Management Plans to guide their maintenance investments. Transit agencies also should provide transparent project prioritization processes that demonstrate how projects are selected. We can expect that as the gas tax increase goes into place, the public will be looking for signs that there is a solid process for how the funds are deployed to ensure that their quality of life will be improved.