The Transform Illinois coalition recently honored school district reform efforts that promised to better use property tax dollars. If you missed the Transformer Awards, here are highlights from the rousing panel discussions.

Andy Recillas

Representative Rita Mayfield (D-Waukegan) and Senator Sue Rezin (R-Morris) after receiving their Transformer Awards for school district reform efforts

Property tax reform is among the most difficult and contentious of policy issues facing Illinois. The 2019 Transformer Awards, created to recognize individuals who are working to streamline local government in Illinois, honored the efforts of IL State Representative Rita Mayfield (D-Waukegan) and IL State Senator Sue Rezin (R-Morris) at pursuing school district reform in Illinois. What’s more, the Transform Illinois coalition, made up of government leaders and civic organizations, wanted to do a deep dive into property tax reform issues facing Illinois.

Back in August, Governor Pritzker signed a bill pushed by IL State Representative Jonathon Carroll (D-Buffalo Grove) to create the Illinois Property Tax Relief Task Force to look holistically at ways to offer property tax relief in the wake of the fair tax referendum. The task force is charged with examining methods of reducing property tax burden while providing quality education to all students in Illinois. The Transform Illinois coalition asked a few members of the task force to preview of the findings, in addition to school funding and school district consolidation.

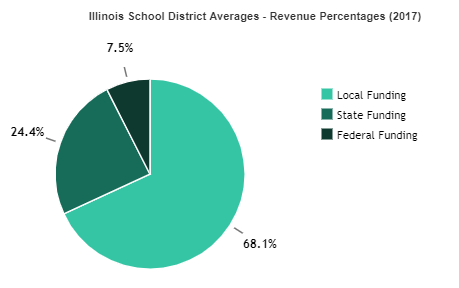

Illinois State Board of Education, 2017

Insufficient state funding to schools put pressure on property tax rates. One committee on the task force is examining school funding and how reforming the governance of our school districts should also be pursued to more effectively use tax dollars for the classroom. Most property tax dollars go to school districts. 706 school districts are below the state-defined adequacy level. $6.8 billion would be required to bring all districts up to adequacy. Despite the Illinois Constitution requires that the state of Illinois be the primary source of school funding, the state provides only 24% of funding for school districts. As a result, school districts depend on local property taxes. Dependency on property tax allows wealthy districts to provide premium services while the majority of districts are below adequacy.

Dependency on property tax allows wealthy districts to provide premium services while the majority of districts are below adequacy.

“Several experts said that there's a better end result if you have a continuum of the curriculum from K through 12,” says Senator Rezin. “As we talk about all of these topics and how to properly fund school districts we looked at the cost of administration.” She is currently engaged in efforts to more effectively spend money on school district administrative services and to use savings in the classroom and for property tax relief. Senator Rezin introduced a bill last session that would do just that, SB1287, which would enable school district residents to direct their superintendents to explore service-sharing agreements.

Restructuring government through consolidation. Much of the discussion around consolidation in the last few years has focused on township and single-purpose governments. For example, in 2017 SB3 was passed that allows counties to eliminate single-purpose governments, such as lighting districts, mosquito abatement districts and drainage districts. In this session, HB348 was passed, allowing McHenry County to dissolve its township governments by referendum.

But the unit of government that would most impact property taxes would be school district consolidation. States like Vermont have passed school district consolidation efforts that define a minimum district enrollment level to define a minimum ideal school district size—900 students in the case of Vermont. We need to better understand the impacts of school district consolidation on our communities and the state. Rep. Mayfield hopes to do just that with her bill HB3053 that would create the School District Efficiency Commission. “There is an opportunity for substantial efficiencies”, says Rep. Mayfield. “We should be pursuing those. It is in the best interest of everyone in the community and throughout our state.”

Andy Recillas

From (L) to (R); DuPage County Chairman Dan Cronin, Senator Donald DeWitte (R-St. Charles), Chicago Metropolitan Agency for Planning Executive Director Erin Aleman, Representative Sam Yingling (D-Grayslake) after the transform Illinois property tax reform panel.

The impact of the property tax extension limitation law (PTELL). PTELL is designed to limit the increases in total taxes billed for the property tax, slowing the growth of property tax revenues that exceed inflation. If a taxing district determines that it needs more money than is allowed by the limitation, it can ask the voters to approve an increase. “PTELL on paper is a good idea. You think it's going to provide some predictable tax caps. But it just incentivizes the maxing out of everyone's levy,” says State Representative Sam Yingling (D-Grayslake). “So, one of the things that we're looking at in regards to PTELL is to do a clawback provision.”

Governments max out their levy due to fear of revenue shortfalls and being unable to increase taxes to a future level if it is needed. A clawback provision will allow governments to collect foregone tax increases that were not collected, allows for flexibility to increase the levy, if needed, in the future instead of increasing the levy to the max every year.

Statewide impacts of tax increment financing (TIF). The choice when or not to use TIF is a hotly debated topic. So is the real impact of TIF to other units of government and the ability of the state overall. “TIF districts in large part are just a mechanism to redirect education funding from schools into a development, says Rep. Yingling. “[In Chicago] more education dollars go from the state government to CPS and don't make it to suburban districts and downstate districts.” Instead of project-specific development incentives that have the potential to carry high transaction costs, Dr. Rachel Weber from the University of Illinois at Chicago offers a path forward around TIF utilization in Chicago, including using all the tools in the development toolbox.

How to make the TIF process more transparent? Creating a city-wide capital improvement plan can allow potential projects to be evaluated through a long-term process that forecasts future project needs, costs, and potential funding sources. A citywide balance of investment is in the best interest of taxpayers. All residents can then understand the impact on their tax bill and what the city receives in return.

Transparency for property tax assessments. Improving the transparency of data for fair property assessments will help the public understand how their property is valued and could provide a way to more accurately forecast future property assessments. “We supported the effort of Cook County Assessor's effort to get more transparent data to be able to evaluate property tax assessments…to see that as a statewide initiative I think would be really great.” Says Chicago Metropolitan Agency for Planning (CMAP) Executive Director Erin Aleman.

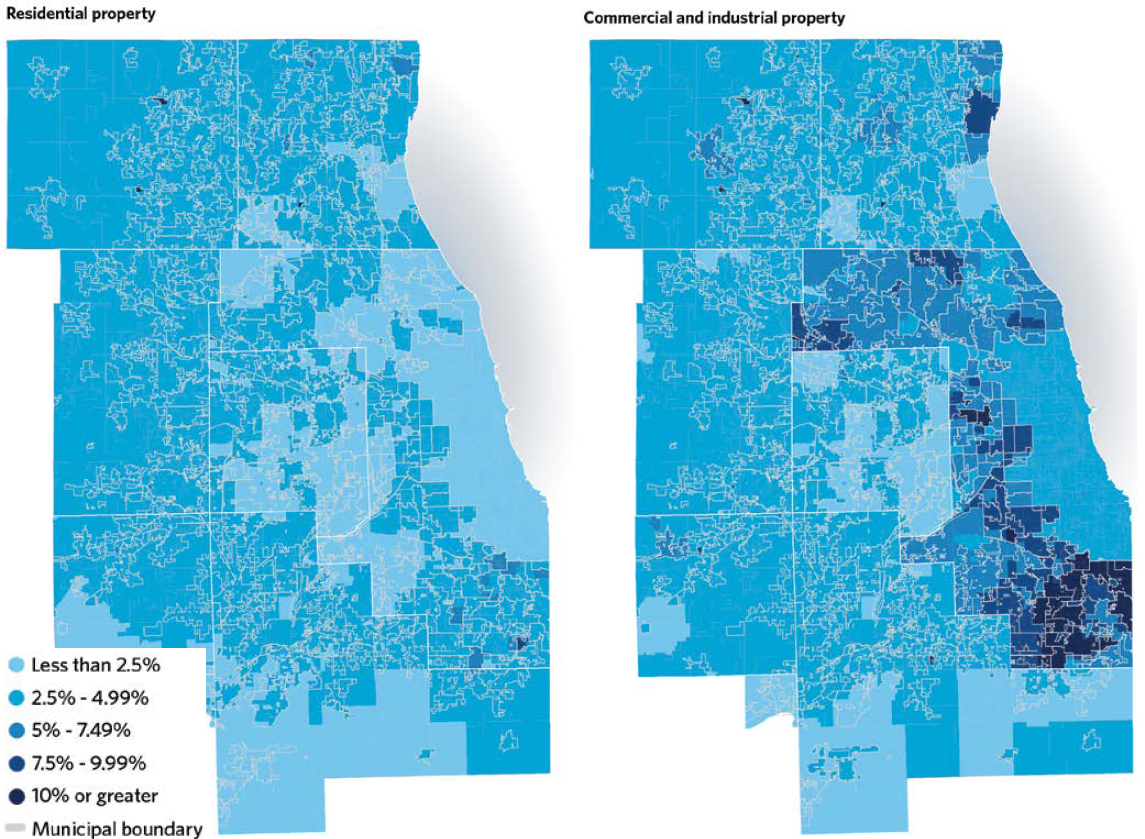

Chicago Metropolitan Agency for Planning, 2017

In Cook County property is assessed at 25% of its value and residential property is assessed at 10%, and as a result, the effective tax rate on commercial property is much higher in communities with limited taxable property base. CMAP’s report on the property tax burden in the Chicago region shows that Cook County’s property tax assessment classification system results in a higher effective tax burden on commercial and industrial property taxpayers relative to residential properties.

What about pension reform? As we all know, pension liability is a challenge here in Illinois. There are $134 billion in unfunded liabilities in Illinois’ five statewide public pension funds. Chicago has roughly $28 billion in liability across its four funds. The collective unfunded liabilities for 650 suburban and downstate police and fire pension funds ballooned to $11 billion as of the 2017 budget year.

Governor Pritzker’s Illinois Pension Consolidation Feasibility Task Force report describes ways to improve our pension system. “With 653 management firms and 653 accounting firms and 653 attorneys it [pension management] has become a cottage industry in some areas,” says State Senator Donald DeWitte (R-St. Charles). “Some of those services to those 653 pension funds could certainly be consolidated, literally saving hundreds of millions of dollars that drop right to the bottom line of taxpayer’s property tax bills.”

Some of those services to those 653 pension funds could certainly be consolidated, literally saving hundreds of millions of dollars that drop right to the bottom line of taxpayer’s property tax bills.

With the fair tax on the ballot in 2020, Illinois is in a unique position to create a major shift in the tax burden based on the ability to pay. That will benefit working low- and middle-income families in Illinois as well as address the financial condition of the state. The final report from the property tax relief task force is due to the Governor by the end of the year.

Transform Illinois coalition is pleased that the general assembly is taking such a multifaceted approach to studying the issue and look forward to policy recommendations resulting from the work. There is much to be done in 2020 and Transform Illinois is dedicated to pursuing equitable property tax reform over the long term.