The weak housing market – and the massive “shadow” inventory of homes weighing heavily upon it – has given some the idea that homes have become more affordable. But has affording the roof over their head really become easier for most people? I recently attended a panel discussion at “Bring Workers Home – Boston” that included an analysis of several economic trends and their effect on home prices, with fresh data provided by Robert Clifford, policy analyst, New England Public Policy Center, Federal Reserve Bank of Boston.

On the one hand, Clifford reported that home prices are down:

- The Wall Street Journal noted in February that prices are down to pre-bubble levels, making homes more affordable than they have been in years. "Based on incomes, this is as affordable as it gets," said Mark Zandi, chief economist at Moody's Analytics. "If you can get a loan, these are pretty good times to buy."

- Clifford also cited a New York Times article from March: “Houses in the United States are now more affordable than at any time in the last 40 years, when compared with personal income.”

- According to Paycheck to Paycheck, released in July by the Center for Housing Policy, the income needed to buy a median priced home has dropped by at least 3 percent in more than half of the metro areas studied, due to a combination of low home prices and falling mortgage interest rates.

However, Clifford cited data pointing to significant challenges:

- In reality, the improvement in affordability is closer to early 2000 levels.

- Most households in the United States entered the housing downturn facing cost burdens from housing; few have been able to take advantage of lower home prices.

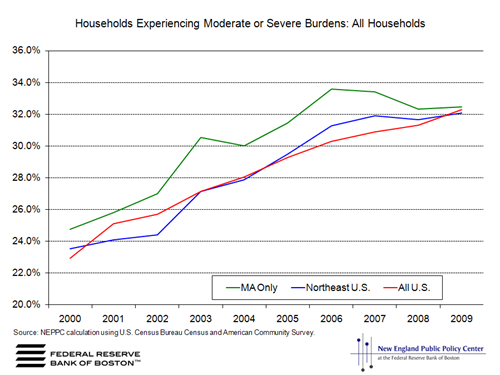

- Housing cost burdens have increased, among both renters and homeowners, as shown in the following chart: More than 30 percent of U.S. households face moderate or severe housing cost burden, leaving them struggling to pay for health care, food, and other basic needs.

- Paycheck to Paycheck further points out that the jobs being created do not pay enough to cover housing, transportation, and other household costs.

- Plus, according to CNNMoney, many Americans cannot get a loan due tighter lending policies and increased downpayment requirements.

- Minorities have had an even harder time accessing credit, according to a recent MPC blog post by Sylvia Puente.

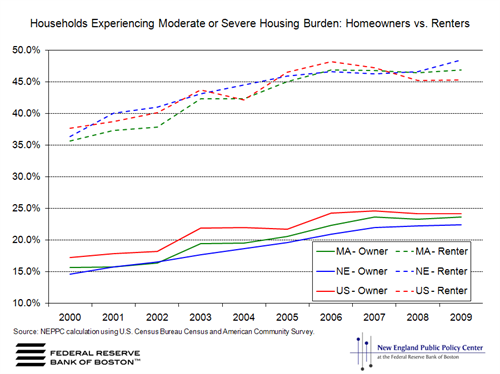

- Generally, we look to renting as a back-up affordable option, but the next chart shows that more than 45 percent of renting households nationwide experience moderate to severe rent burdens. And, as foreclosures continue to mount and more households look for rental options, the supply is tightening, driving up rents even further.

Clifford concludes that the housing downturn has resulted in increased affordability for those able to buy. However, very few households (particularly among lower-income families) are in a position to buy, as they are facing extreme housing cost burdens.