Flickr user EGFocus (cc)

Crossrail under construction at Tottenham Court Road

At roughly $23 billion, London’s Crossrail project may be the most expensive urban transportation project in the world. But its designers—and now real estate analysts—suggest that its benefits make the new line worth the cost.

Crossrail is an express rail line that will speed east-west in a 13-mile tunnel under the city by 2018. The project will link the city’s major airport at Heathrow, several existing rail stations and the business district at Canary Wharf. It will offer several connections with existing London Underground lines and reduce travel times for commuters—connecting Canary Wharf and Heathrow in just 39 minutes, compared to one hour minimum today.

According to Savills, a real estate agency, a minute saved on a commute into the center of London adds $2,023 to a property’s price.

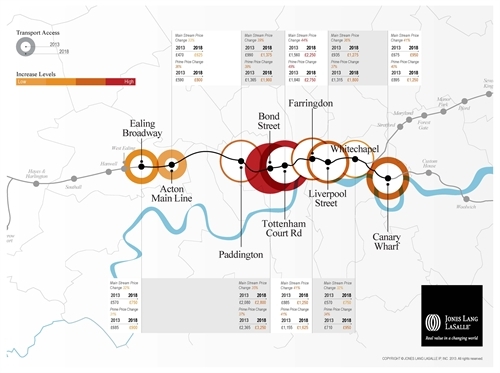

According to a new study from Jones Lang LaSalle (JLL), a commercial real estate firm, the projected reductions in travel times are expected to dramatically increase property values in areas adjacent to Crossrail stations. All new housing in Central London is expected to increase in price by 30 percent by the time the line opens, but JLL’s research “suggests that Crossrail will contribute to residential price increases of between 6 percent and 19 percent above” that. For example, at Tottenham Court Road, one of the major stations along the line, nearby properties are expected to see a 44 percent increase in property prices. New development, like the completed Central St. Giles and the proposed Centre Point mixed-use projects, indicate that the private market is already excited by the prospect.

According to Savills, a real estate agency, a minute saved on a commute into the center of London adds $2,023 to a property’s price.

These study results are similar to those documented by the government agency building Crossrail, which suggests that the line will add £5.5 billion ($8.3 billion) in value to property along the line by 2021.

London’s example suggests that a major investment in new transportation infrastructure produces significant benefits above and beyond those offered by decreasing travel times alone. As part of MPC’s work to explore new ways of funding transportation projects, we have identified value capture – essentially, using some of the increase in property values surrounding a particular transit investment to front the cost of that investment – as a potential source of revenues. Though London is not using this tool to fund its line, other cities like Minneapolis are already considering the advantages of using this approach.

Expected price increases around Crossrail stations

Jones Lang LaSalle